BHM Ventures is an American based premier, dedicated and professionally managed Capital firm that anchors the entire eco-system of Investments and plays a catalyst role in partnering with various start up communities, government organizations, corporate and research sectors. Vision at BHM Ventures is to emerge as Building successful businesses that are socially responsible and providing our investors concrete, vetted business opportunities with long term financial benefits with minimum liabilities.

Vision – 2030

To Surface as a One stop solution for Businesses with controlled Investment and create a platform for funding attractive projects of its Elite, hand-picked projects with greater yields, and source funding from Middle East, North America, Europe, UK and Asia. Our Focus areas with the years coming forward are

The Roar of Market Pressures across different domains will tame the Global Growth in 2024 and the need for Economic Development in Growing Countries will empower Investors like us will look to make financial placements in less liquid assets or private debt and with the aim of moving trade more towards Technology, Healthcare, Aviation, Food Processing, Transport and Logistics etc.

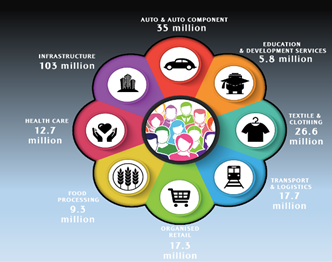

As illustrated in the Image our Study shows that there is huge funding being allocated by various Capitals in respective listed domains which are secured through Government, Public Private Partnership and allowing Foreign Direct Investments in countries that enables us to explore Investment Options based on our Strength and Subject Matter Expertise

Due Diligence is key when making any Investment. We believe in empowering ourselves by being our own Financial Advocate. At BHM our core focus is to secure our investment with lowest possible risks. We qualify the projects from the initial point of interaction to the closure of the deal. We follow various vetting methods which are automated and run through different iterations before finalizing any Investment. Our Goal is to only Invest in Minimum Viable Projects with Industry Return rates.

BHM Due Diligence checklist

This checklist provides an overview of documents and information that we collect before the initiation of the Fund request or Investment into any project. These may not all be relevant depending on the structure and focus of the project.

BHM Investing aims to generate specific Beneficial social or Environmental effects in addition to financial gains. Before Investing into any projects our Due Diligence framework created by our legal experts runs through various implications and potential risks associated with Governments, Financial Institutions and Compliances and Taxation to keep minimum liability for us as an investor and put the ownership with the project owner to complete all requirement and prepare a report that is statutory compliant and legally protected as a company and also the Fund protection. Below are the primary factors that influence any and all legal implications.

At BHM the Governance structure holds the highest value of best practices and existence of critical decision making bodies. Clear definition or roles, approval processes, performance reviews and management functions are in existence.

Conducting the right checks and balances for Investment portfolio with appointment of persons of diverse backgrounds and expertise.

Policies Management

Management of Various Risks

Real Estate & Infrastructure

IT & Digital

Trading

Trading

BHM Ventures is glad to announce the successful closure of below engagements in various domains aligning with our goals and vision for 2030. Below is an highlight of the type of engagement and total value of each business unit.